A trading journal is a record of your trades and the decisions behind them.

Done right, it turns raw executions into insights—so you can repeat what works and fix what doesn’t.

A trading journal is a structured log of:

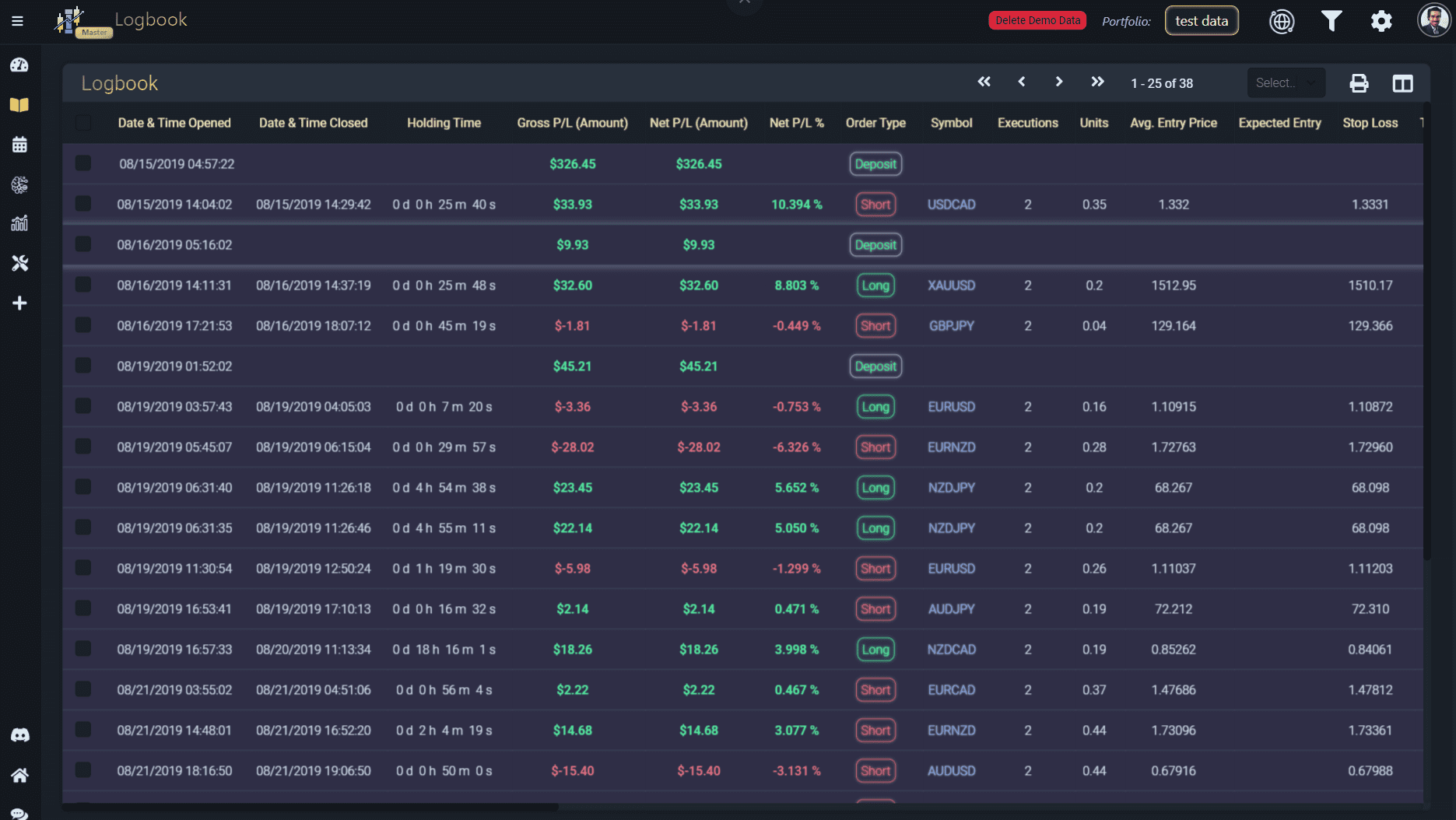

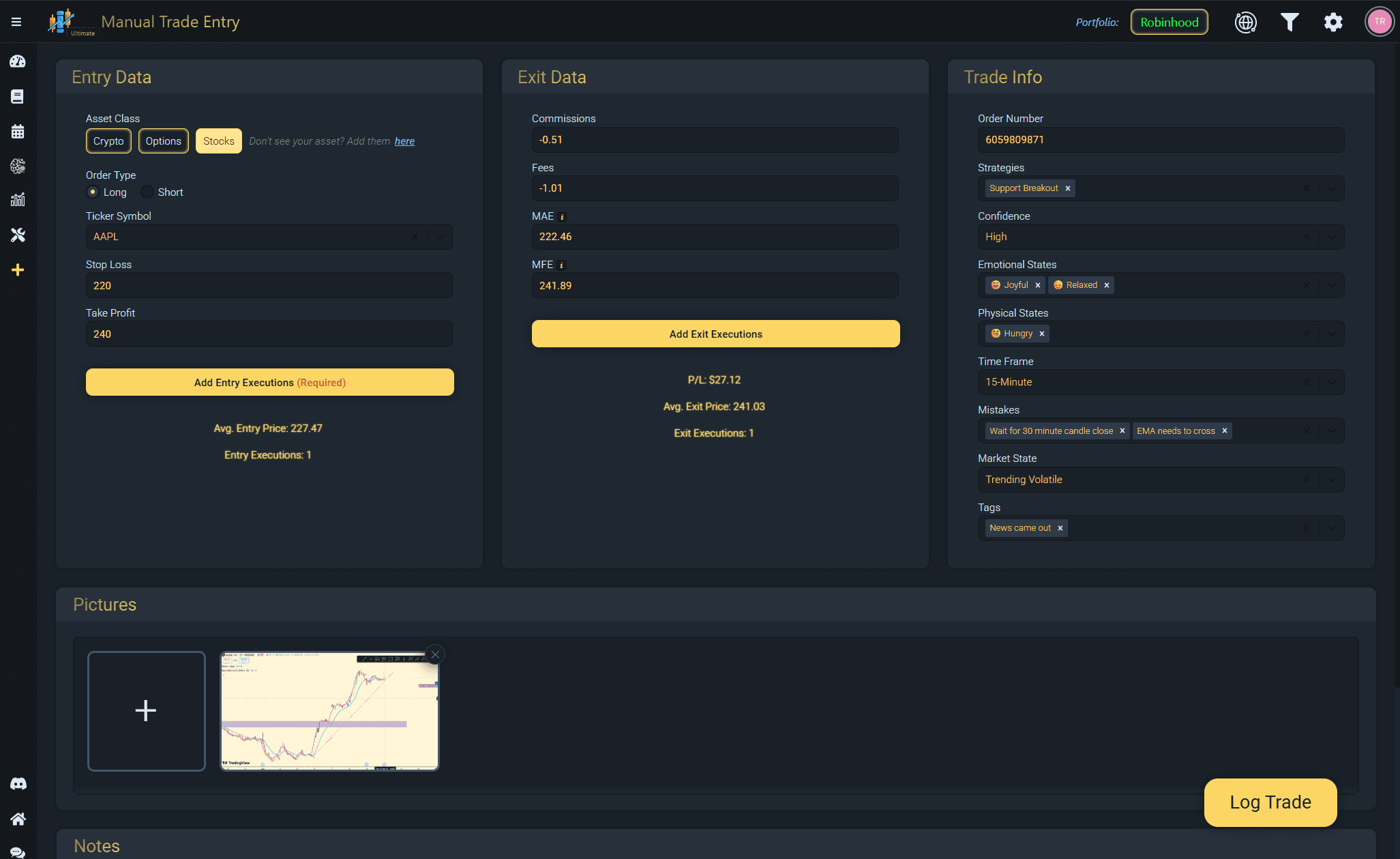

What you traded (ticker/contract), when, and how (entry/exit, size, costs)

Why you took the trade (strategy/setup, thesis, rules)

How it performed (P&L, R:R, max adverse excursion, slippage)

What you learned (mistakes, notes, tags)

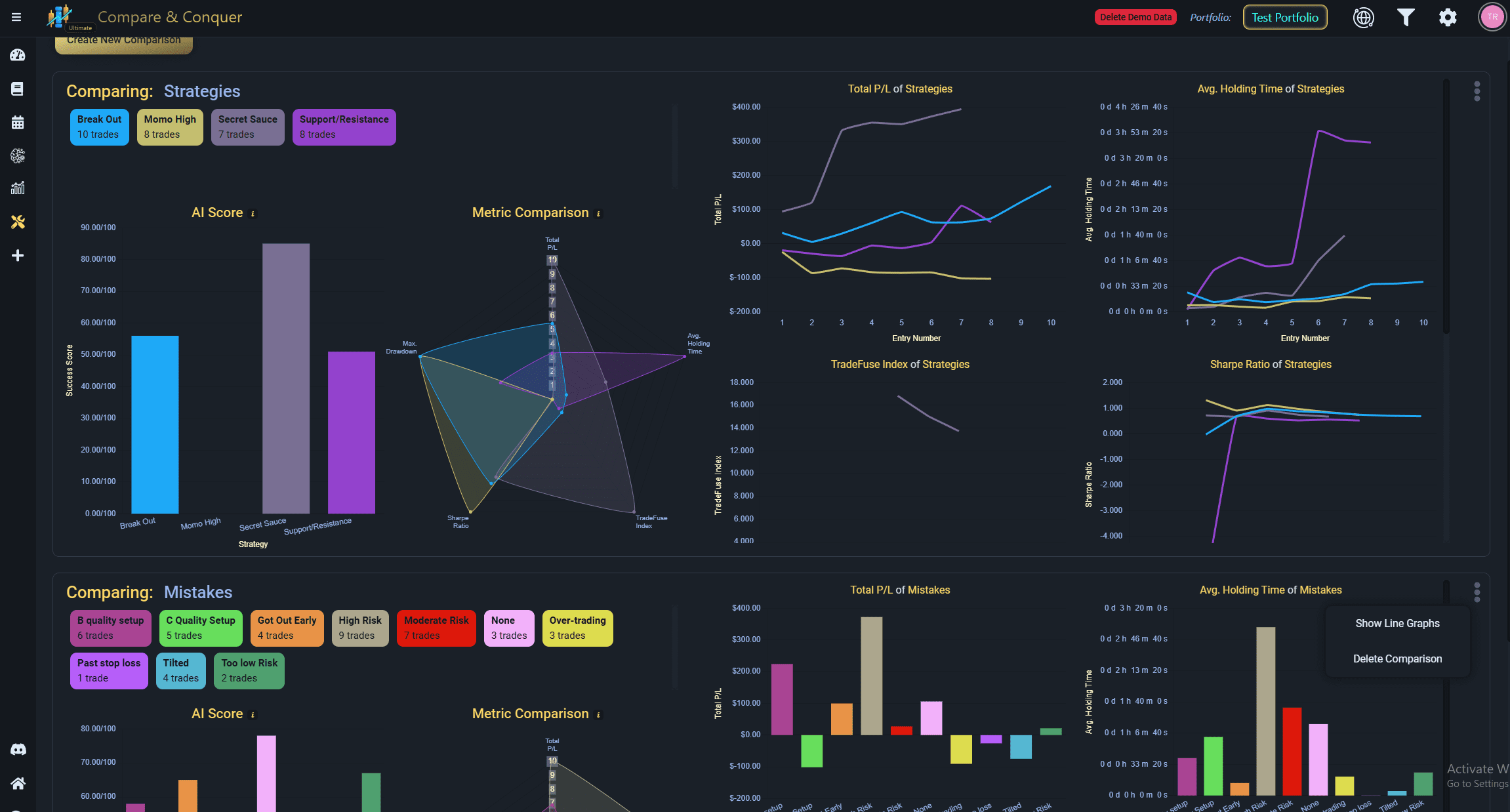

Improves consistency: you’ll spot patterns in winners/losers.

Raises expectancy: focus capital on your best setups.

Controls risk: exposes over-sizing, revenge trades, rule breaks.

Speeds feedback: shortens the loop between action → lesson.

At a minimum, you should log:

Date/time, market/session

Instrument (e.g., AAPL, ES, XAUUSD), side (long/short), size

Entry, stop, target(s), exit(s), fees

Setup/strategies, emotions, tag(s) and screenshots

Pre-trade plan vs. post-trade notes

Outcome: P&L, R multiple, win/loss reason